[New Version] Opportunity Zones & Qualified Opportunity Funds: An Emerging Economic Development and Investment Tool Worth Considering

- posted: Dec. 18, 2019

- Accounting, Employment Law, Marijuana Laws, Gun Licensing, Non-Compete Agreements, Online Agreements, User Agreements, Estate Planning, Tax Laws, Mortgages, Real Estate, Nursing Homes, Trusts, Personal Injury, Vaccine Injuries, Business Use, Insurance Coverage, Digital Assets, Business Law, Capital Gains, Economic Development, Opportunity Zones, Real Estate Development, Current Newletter

The Opportunity Zone program is an important new community economic development and investment tool created in late 2017 by the federal Tax Cuts and Jobs Act. This program is designed to incentivize long-term private investments in economically distressed communities (including a number of areas in the SouthCoast) through a highly tax-advantaged investment vehicle called a “Qualified Opportunity Fund” or “QOF”.

Opportunity Zones, along with their related Qualified Opportunity Funds, have recently received a great deal of media attention and interest as a result of the U.S. Treasury Department’s recent publication of long-awaited guidelines for implementing this new program. These new federal guidelines provide potential stakeholders with much-needed clarity as to a number of essential questions, including but not limited to: (1) who can create a Qualified Opportunity Fund; (2) how such a fund is to be created and certified; (3) what types of investments are eligible to receive the potential tax-advantages contemplated under the Opportunity Zone program; and (4) how Qualified Opportunity Fund investments are required to be invested and held in Opportunity Zone property and businesses.

Interest in Opportunity Zone investment has been particularly strong among real estate developers, taxpayers who have (or may soon) realize a substantial short- or long-term capital gain, as well as those who have recently started (or are considering starting) a new business in the SouthCoast area. To date, there has been little guidance available to individuals and small businesses seeking to understand, in practical terms, how this program can work for them.

So what, exactly, are Opportunity Zones (a.k.a. “O-Zones”) and Qualified Opportunity Funds? What are the benefits and risks of investing in one? And why do opportunity zones matter to SouthCoast communities, businesses, and investors?

What is an Opportunity Zone?

The Opportunity Zone program works by providing potential long-term investors with the ability to invest newly realized capital gains into a Qualified Opportunity Fund, which is then required to reinvest its assets into projects and businesses in designated Opportunity Zones. Qualified Opportunity Funds are privately-managed investment vehicles that are organized for the purpose of investing in Opportunity Zones. By doing so, QOF investors can thereby reap a number of preferential tax benefits, including:

- Temporary Deferral of Capital Gains Taxes on realized capital gains that are timely invested into a QOF. By statute, this deferral periods ends on the earlier of two dates – in 2026 or when the investment is no longer held by in the QOF;

- Step-up in Basis of up to 15% on realized capital gains timely invested in a QOF and held for a period of at least 5 years (for a 10% step-up) or at least 7 years (for a 15% step-up); and

- Potential for Permanent Exclusion from taxable income of all capital gain accrued on the investment while in a QOF- if that investment is held in the QOF for at least 10 years.

While the Opportunity Zone program was established in late 2017, actual investments in Opportunity Zones are just beginning to pick up momentum now that the federal government has completed its designation of qualified Opportunity Zones and issued its second set of proposed regulations last month.

What is an Opportunity Fund?

A Qualified Opportunity Fund, in the most basic sense, is an investment vehicle organized as a corporation or partnership through which a taxpayer is able to invest a recent capital gain into Opportunity Zone property and thereby defer payment of capital gains tax on the invested gain, while also potentially receiving a “stepped-up basis” for the invested gain. While step-ups in the basis of the initial investment can be realized by holding the investment in a QOF for 5 years (for a 10% step-up) or 7 years (for a 15% step-up), the maximum tax advantages of this program are best realized with a 10 year hold period.

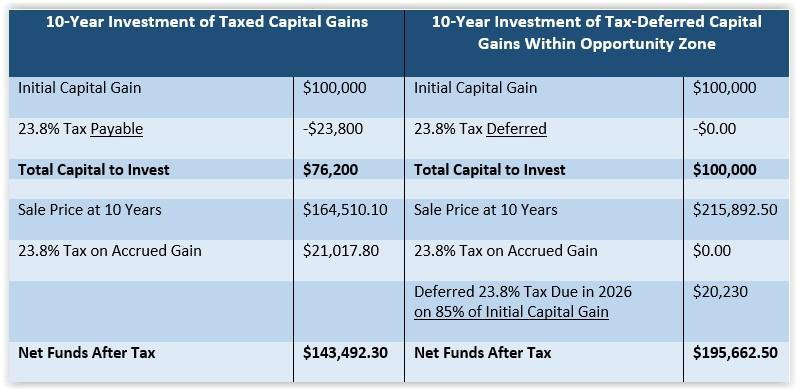

Assuming that a timely invested capital gain is held in a QOF for 10 years or more, only 85% of the taxpayer’s initially invested capital gain will be subject to assessment of capital gains tax at the end of the deferral period and, in addition, any additional gain accrued on the investment within the QOF is exempt from capital gains taxes altogether.

Presented below is an example comparing a 10 Year investment of an initial capital gain of $100,000 inside a QOF with an equal investment outside a QOF, assuming an ~8% annual appreciation, a 20% long-term capital gains tax rate, and a 3.8% net investment income tax rate. This is a relatively conservative example. If the 8% annual appreciation is increased, the benefits after ten years get even better:

In order to qualify for this beneficial tax treatment for invested gains for its investors, a QOF entity is required to hold at least 90% of its assets in qualified opportunity zone property. Such property can include “qualified opportunity zone stock”, a “qualified opportunity zone partnership interest”, or “qualified opportunity zone business property”. As to each type of property, the statute and recent guidelines set forth additional provisions for determining whether a particular property will qualify for QOF investment.

What are some of the Benefits and Risks of Opportunity Zone Investments?

In addition to the potentially generous tax benefits described above, investments in Opportunity Zones have great potential to encourage private, long-term investment of capital into communities that are often overlooked for such investments.

There are risks inherent in this program. First, a distressed zone is likely to be a risky market for some kinds of ventures. If the QOF is not managed by the investor himself, there is the risk that the operator may not excel or that the business may not flourish. Unless you are the investor and you are familiar with the business and market, there are normal and some increased risks. The investor’s knowledge, risk tolerance and other assets will obviously be determinative if this is a good vehicle. The after tax investment consideration are very generous, but if there is a substantial risk of capital, that benefit might not be worth the risk. Careful due diligence is required as in all investments.

While QOFs can be complex, they do not have to be – single project and closely-held QOFs are also an option and may have the added benefit of mitigating some of the risks associated with QOFs designed to aggregate, manage, and invest funds from passive outside investors. Single project or closely-held QOFs may be particularly useful for those of us who live and work in the SouthCoast, have personal experience and familiarity with our local Opportunity Zones, and wish to invest in our communities.

The Opportunity Zone program expressly allows a QOF to be established by any taxpayer and self-certified with the IRS. That QOF can then be used as a vehicle to timely invest that taxpayer’s own recent capital gains into the QOF for further investment into the qualified Opportunity Zone property of that taxpayer’s creation and control. Importantly, QOF investments are not limited to the purchase and improvement of real estate – they can include investments in a wide variety of new businesses and potential start-ups within an Opportunity Zone.

Why do Opportunity Zones matter to SouthCoast communities, businesses, and investors?

The SouthCoast area now includes several designated Opportunity Zones covering portions of New Bedford, Fairhaven, Fall River, Somerset, Taunton, and Wareham. A basic map of the boundaries of each designated Opportunity Zone is included below and a more detailed map can be accessed here.

If you are interested in learning more about how you or your business can access the economic development and investment opportunities presented by the Opportunity Zone Program, please contact us. We stand ready to assist you with identifying ways in which you can use this promising new program to jumpstart both initial and follow-on investment and economic development projects within our SouthCoast community.

Robert B. Feingold, Esq. & Heather Bonnet-Hébert, Esq.

Email: [email protected]

Email: [email protected]